AI in Insurance - The new disruptor

Predict and Prevent’ is the new wave in insurance enabled by AI.

While ‘predict’ means the use of predictive data modeling techniques that helps insurers identify and target potential markets where the need for insurance is high, ‘Prevent’ means to make use of data to reveal behavior patterns, common demographics, and characteristics, so insurers can take proactive actions to prevent last hour claim processing and fraud.

The need for AI in insurance

What makes AI enter the world of insurance is the astonishing amount of data that the industry has, which was, before AI, processed and interpreted manually – a cumbersome task. AI and its subset deep learning however mimic the perception, reasoning, learning, and problem-solving of the human mind and transform that data into actionable insights that everyone from agents to executives can use to make decisions. AI empowers insurers to deliver more personalized customer experiences throughout the value chain, from underwriting to new product development.

Leveraging AI to drive value

AI adds another dimension of value by introducing automation. With AI-backed data pipelines, insurers optimize risk assessment and claims processing.

Improve customer experience with optimized offerings

Although technology offers an elevated experience, customers still want human interaction. AI in Insurance enables seamless customer interaction by serving up the information and insights insurers need to recommend the right insurance products at the right time. This saves time and money through the stages of product development and raises the likelihood that new products will be successful.

Align AI initiatives with business priorities

Undertaking an AI initiative is an iterative process. As per research, 70 percent of companies that successfully scale AI projects link their AI goals to their business strategy. Since AI can’t operate with the wrong information or information that’s poorly organized, the quality of data underpins the success of AI initiatives and is critical for its successful implementation to support your business objectives.

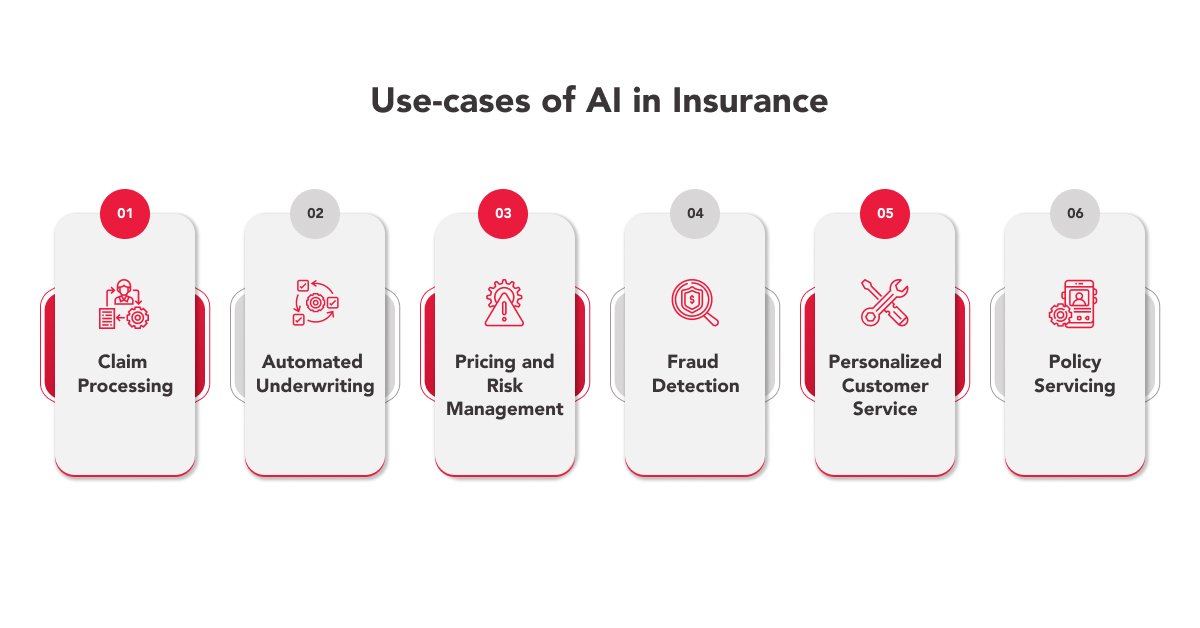

Use Cases

Claim processing

Mostly paper-based and rarely end-to-end digitized, the claims management process can wipe away up to 50%-80% of premiums’ revenues. Plus, insurers need to ensure that the claims meet the requisite criteria throughout the process cycle. AI and Machine Learning make the entire process efficient and effective. The algorithms effectively scan all the incoming data, interpret it instead of insurance agents, and provide faster settlement to end-users. It dramatically improves the claims processes value chain, saves time, and frees employees to focus on more complex claims and direct customer contact.

Automated Underwriting

Before AI and ML, insurance underwriting was heavily employee-dependent. They had to analyze heaps of historical data by working with haphazard systems, processes, and workflows. With AI, underwriters have access to a larger volume of high-quality information that helps them better assess risk and meet customer needs. Additionally, AI can assess large datasets that extend into all areas of policyholder behavior and asset management. Machine Learning algorithms collect and make sense of massive amounts of data, improve rules performance, manage straight-through-acceptance (STA) rates, and prevent application errors.

Pricing and Risk Management

Insurance companies mostly use GLMs (Generalised Linear Models) for price optimization for sectors like car and life assurance. This technique allows insurance companies to better understand their customers’ balance capacity and upcoming demand.

By combining RPA with machine learning & cognitive technologies to create intelligent operations, assessing the price of a product and risk assessment becomes fairly simple. As the automated process significantly reduces time, insurers can deliver a better customer experience and reduce churn.

Policy Servicing

When it comes to policy administration, AI can add value to the customer while helping insurers collect better data to optimize policy offerings. It automates transactional and administrative activities such as accounting, settlements, risk capture, credit control, tax, and regulatory compliance.

Fraud Detection

A Federal Bureau of Investigation study on US insurance companies revealed that the total cost of insurance fraud (non-health insurance) is close to more than $40 billion per year. That means Insurance Fraud costs the average US family between $400 and $700 per year in the form of increased premiums.

These figures are startling! AI-powered predictive analytics and text analysis tools detect fraudulent claims based on business rules with data captured from the claimant’s story. Insurance companies can also benefit from voice analytics to understand if a customer is lying while submitting a claim.

Personalized services

According to an Accenture study, 80% of insurance customers want more personalized experiences and are willing to disclose their data in exchange. By using AI, insurance companies can better understand their customers and offer customized products that enable individuals to only pay for the coverage they need. This increases the appeal of insurance to a wider range of customers, considering that 9.2% of people in the USA have no health insurance, some of them may then purchase insurance for the first time.

Future of AI in Insurance

In the future, AI tools and automated assistants will become commonplace across the insurance company’s technology stack, enabling professionals to make more informed decisions in managing risk across the business.